|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

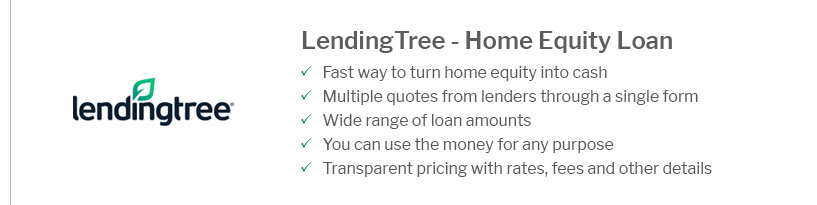

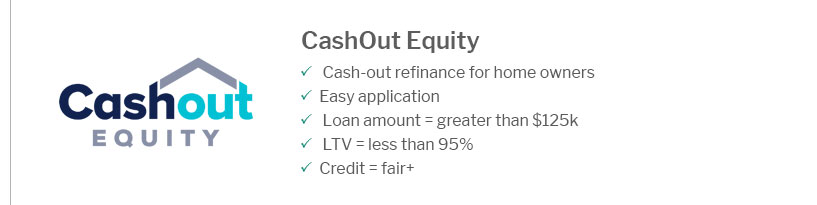

Understanding Real Estate Refinance: What to Expect and How It WorksReal estate refinance is a powerful tool for homeowners looking to optimize their financial situation. By refinancing, you can potentially lower your interest rates, adjust the term of your loan, or access equity in your home. However, it's important to understand the process and implications fully. Benefits of Real Estate RefinanceRefinancing your mortgage can offer several key benefits, but it's essential to assess whether it aligns with your financial goals. Lower Interest RatesOne of the most compelling reasons to refinance is the possibility of securing lower harp home mortgage interest rates. This can significantly reduce your monthly payments and the total amount paid over the life of the loan. Shorten Loan TermRefinancing can allow you to switch from a 30-year mortgage to a 15-year mortgage. This change can save you money on interest, helping you pay off your home sooner. Access Home EquityIf you have built up equity in your home, refinancing can provide access to funds for home improvements or other financial needs. Steps to Refinance Your HomeUnderstanding the refinancing process can help streamline your experience.

Potential DrawbacksWhile refinancing can offer numerous advantages, it's important to be aware of potential downsides.

Understanding the refinance mortgage meaning and its implications can help you make a more informed decision. FAQs About Real Estate Refinance

https://www.investopedia.com/terms/c/cashout_refinance.asp

A cash-out refinance allows you to use your home as collateral for a new loan, creating a new mortgage for a larger amount than currently owed. https://www.key.com/personal/banking101/refinance-a-house.html

What are the benefits of refinancing a house? - A lower interest rate on your mortgage - More manageable, lower monthly payments - A shorter term - Costs you can ... https://www.investopedia.com/terms/r/refinance.asp

A refinance occurs when a borrower replaces an existing loan with a new loan to improve the terms, such as the interest rate, amount borrowed, and length of the ...

|

|---|